Implications of H.R. 1 – the One Big Beautiful Bill Act

On July 4, 2025, President Trump signed H.R. 1, the Reconciliation Bill (aka the “One Big Beautiful Bill Act”) into law, which includes significant policy changes to Medicaid and the Health Insurance Marketplaces.

AMCP—and various other health care associations—voiced their concerns about H.R. 1 in the months leading up to the bill’s passage. But despite our calls to action urging lawmakers to protect vital Medicaid funding, Congress enacted cuts of approximately $1.15 trillion on federal health care spending over the next decade.

From Proposal to Policy: Implications of H.R. 1 on Medicaid and Public Coverage

The final version of the bill included further constraints on state Medicaid financing and eligibility and significantly scaled back Marketplace subsidies for certain populations.

By the government’s own estimates, these cuts will result in the loss of health coverage for 17 million Americans, including some of the country’s most vulnerable populations—children, pregnant women, disabled individuals, seniors, and veterans. These losses will occur from stricter eligibility rules, shorter retroactive coverage periods, and more frequent eligibility verifications.

The magnitude of these reductions, and the number of individuals who will lose health coverage, cannot be simply dismissed as waste, fraud, and abuse. These changes will result in less preventive care and more preventable emergency room visits, which will threaten hospitals with closure and ultimately increase costs for everyone across the health care system.

Five Critical Consequences of H.R. 1:

Medicaid program cuts

Over $1 trillion in reductions will likely force millions to lose their healthcare coverage, with some estimates calculating that 17 million people will lose care. Many vulnerable groups, including the 40% of children who rely on Medicaid, are in jeopardy of losing insurance. Because Medicaid is jointly funded by states and the federal government, reducing federal support forces states to either cut benefits, eligibility, or provider payments—or shift more cost burden to states and recipients.

Widening coverage gaps for rural and underserved populations

Rural and underserved communities are particularly harmed by H.R. 1. Reduced provider funding and hospital closures will disproportionately impact these groups, leaving them with fewer care options and ultimately, worse health outcomes. Provisions in the bill will force lower reimbursement rates on hospitals and other providers, and push states to enact more drastic cuts to their Medicaid budgets. While the law’s Rural Health Transformation Fund allocates $50 billion in grants for rural health care efforts, early estimates suggest the fund would only offset about one-third of the losses in health care funding to rural areas, leaving rural hospitals that were already struggling to stay afloat even more vulnerable to shutting down.

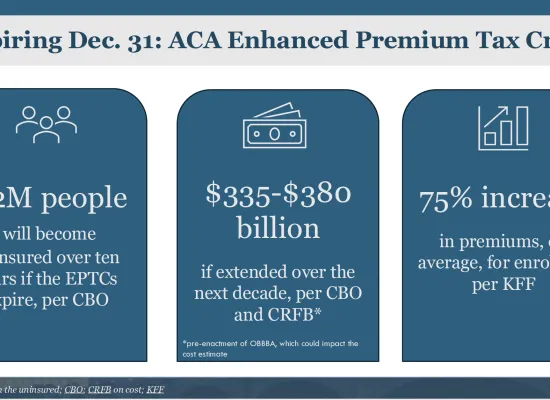

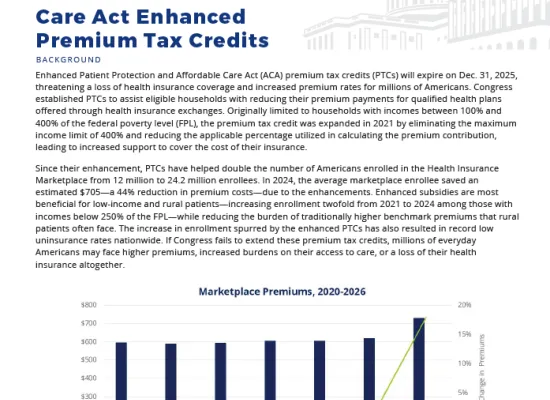

Significant scaling back of Marketplace subsidies and exchange plans

More than 7 million people who currently get their health insurance on the marketplace are projected to lose coverage, and those who enroll in marketplace plans will face higher premiums. Changes in the bill—including the bill’s shorter open enrollment periods, elimination of automatic re-enrollment, and reduced eligibility for tax credits—are likely to compound with the expiration of COVID-era subsidies to make healthy individuals more likely to forgo coverage. This would increase premiums and result in further gaps in care for everyone.

More administrative hassle for Medicaid patients

New work and community engagement reporting requirements add additional hassle for patients, causing them to lose coverage due to paperwork barriers and confusion rather than actual ineligibility. H.R. 1 requires Medicaid recipients’ eligibility to be evaluated at least every six months, compared to the annual redeterminations that were standard previously. These additions are expected to increase enrollment churn, even for those who are eligible. The law also includes work/community engagement mandates and reduced eligibility for non-citizens. Work requirements in states like Arkansas and Georgia have already caused eligible individuals to lose coverage due to confusion and complexity.

Student loan support cuts & potential health care worker shortages

AMCP remains concerned with sweeping cuts to federal student loan programs, including those relied upon by pharmacy students nationwide. Cuts to loan forgiveness, repayment assistance, and loan options such as Grad PLUS, may deter students from pursuing pharmacy degrees. These cuts are likely to exacerbate future workforce shortages, limiting access to care while generating significant strain on the greater health care system.

What Now?

AMCP urges policymakers to prioritize sustainable reforms that protect patient coverage and strengthen the healthcare system rather than creating barriers to care. We will continue to urge Congress to restore vital funding before 2027 implementation deadline.

Save this page and subscribe to our newsletter to stay up-to-date on the latest H.R. 1 implementation news and updates.

Related Resources

Medicaid and Medicare Implementation Timeline: Major Milestones

Implementation Timeline for Medicaid Changes:

- December 31, 2025: HHS to release implementation guidance on the eligibility redetermination requirements.

- October 1, 2026: Narrowed definition of qualified immigrants for Medicaid and CHIP eligibility takes effect.

- December 31, 2026 (not later than): States must implement work requirements for certain Medicaid enrollees, with exceptions.

- January 1, 2027: States must make eligibility redeterminations every 6 months for Medicaid expansion adults; retroactive coverage limitations

- September 30, 2034:

- Moratorium on Medicaid Eligibility and Enrollment Final Rules expires.

- Moratorium on skilled nursing facility nurse staffing ratio rule expires.

Implementation Timeline for Medicare Changes:

- January 1, 2026: Start of one-year 2.5% Medicare physician payment increase.

- February 1, 2026 (not later than): Expands orphan drug exclusion; clarifies start date for Drug Price Negotiation Program eligibility.

- July 4, 2026: Commissioner of Social Security must identify and notify those no longer eligible due to immigrant restrictions.

- January 4, 2027: Effective date of limitation of Medicare eligibility for certain immigrants.

Upcoming Events

AMCP offers a wide variety of educational opportunities, from events and webinars to online training.